Are car loans based on compound interest or simple interest? Many people wonder how interest is applied to car loan compound interest, especially when dealing with credit unions. It’s important to understand how your monthly payment, loan rates, and total interest are affected by the type of interest used. Credit unions typically use simple interest for car loans. This means that the interest is calculated on the loan amount for each period and does not compound over time. The amount of interest you pay depends on the loan balance and the life of the loan.

How Does Interest on a Car Loan Work?

When you take out a car loan, the interest is calculated based on the loan amount and the loan rates. Your monthly payment includes a portion of both the principal and the interest. Over time, as you pay off the loan balance, the amount of interest paid decreases, and more of your payment goes toward the principal. This ensures that the interest you pay is spread out over the life of the loan.

The Difference Between Simple Interest and Compound Interest

Information You Need to Know About Auto Loan Interest

Car loan compound interest is the cost you pay for borrowing money. Loans typically use either simple or compound interest, with simple interest being more common for car loans. Interest is charged based on the principal loan amount and affects the amount of interest you pay over the life of your loan. If you repay the loan early, you might reduce the total interest paid, especially if the loan uses simple interest.

How Car Loan Interest Rates Work

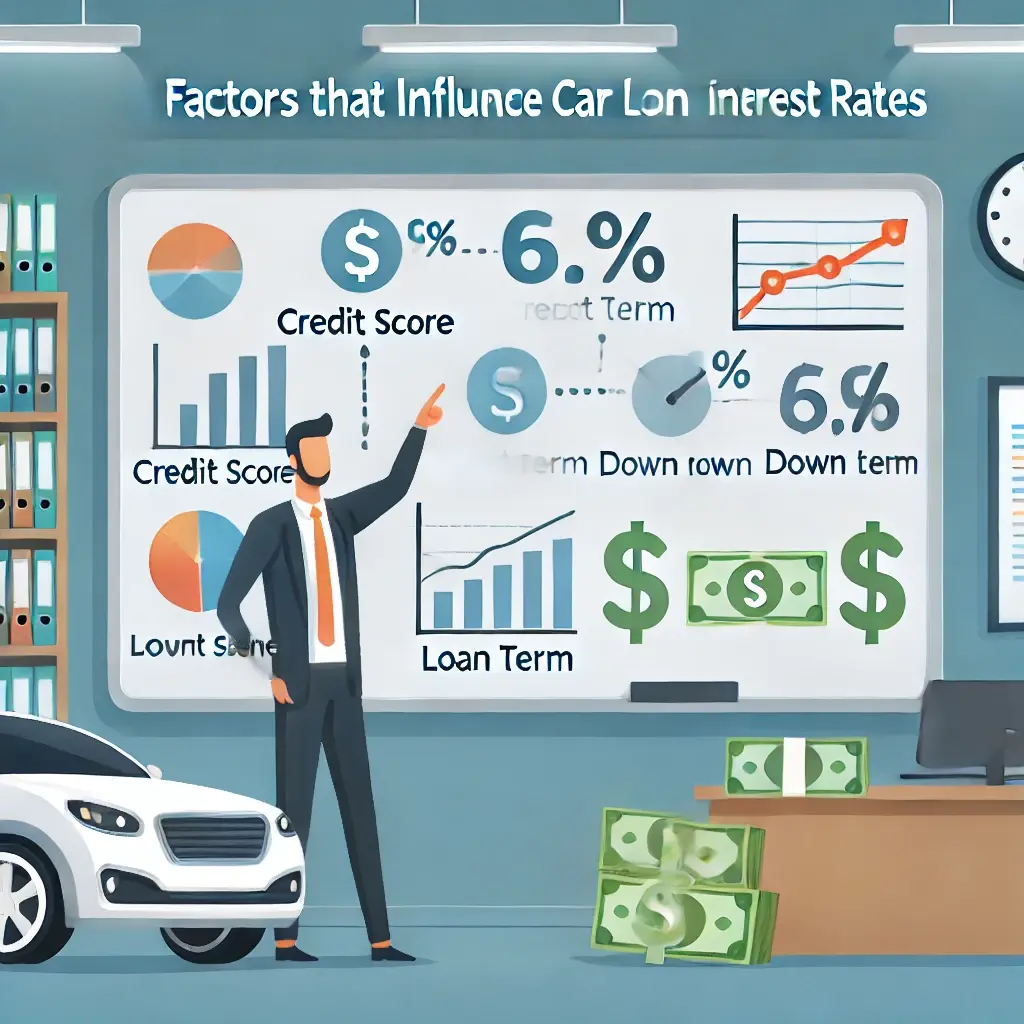

Factors That Influence Car Loan Interest Rates

Several factors influence car loan compound interest rates. Lenders consider your credit score, the loan term, and whether you are buying a new or used car. Higher interest rates often apply to borrowers with poor credit scores. On the other hand, those with better credit can secure lower interest rates. The amount of interest you pay over the life of your loan will also depend on these factors, as well as the length of your loan repayment period.

How to Find the Best Car Loan Interest Rates

Simple Tips to Pay Less Interest on Your Car Loan

- To pay less interest on your car loan, focus on making larger loan payments.

- When you make extra payments toward interest, you reduce the accumulated interest over time.

- This can significantly lower the total interest charged on your loan. If you can, pay off your loan early.

- This will also help reduce the overall interest calculation and save you money in the long run.

- Using an auto loan calculator can help you understand how your payments affect the interest rate.

Credit Union Car Loans

Why Choose a Credit Union for Your Auto Loan?

Choosing a credit union for your auto loan can benefit you in several ways. Credit unions typically offer lower auto loan rates compared to traditional banks. They focus more on the needs of their members rather than maximizing profits. With a lower interest rate, your monthly payments will be more affordable, and you’ll pay less toward interest over the life of the loan. A credit union auto loan can help you save money on the cost of the car by lowering the total amount of interest charged.

How Credit Unions Offer the Best Interest on Car Loans

Using a Credit Union Loan Calculator for Your Car Loan

A credit union loan calculator helps you estimate your car loan payments and interest rates. By entering details such as the loan amount, annual interest rate, and loan term, you can calculate your monthly payments. This tool helps you compare car loan rates and determine how much you will pay down over time. It can also show how paying off your loan early can reduce your loan balance and interest costs, ensuring you get the best deal possible. Before committing to a car loan, you can use a repayment calculator to estimate your monthly payments and interest costs. This can help you better understand how much you’ll be paying over time.

Comparing Car Loans for New and Used Cars

Interest Rates for Used Car Loans vs. New Car Loans

When comparing car loans for new and used cars, it’s important to consider the interest rates. New car loans often come with lower auto loan interest rates than used car loans. This means that the interest on a new car loan is calculated based on a lower rate, resulting in a lower total interest paid over the life of the loan. Used car loans tend to have higher rates because the car’s value decreases faster, which affects the loan terms.

How to Get the Best Auto Loan for a Used Car

Do Used Car Loans Charge More Interest?

Yes, used car loans typically charge more interest than new car loans. This is because the principal loan amount for used cars is often lower, but the interest rates are higher. Lenders may charge more interest to cover the higher risk associated with used cars. The loan terms and conditions for used cars are different from new cars, resulting in higher interest costs over the life of the loan. You may pay more in interest owed for a used car loan.

Choosing the Right Loan for Your Needs

Things to Know About Auto Loan Terms and Conditions

When choosing the right loan for your situation, consider the loan terms and conditions carefully. The loan is a type of financial agreement where you agree to repay the principal loan amount along with interest. You should also understand whether the loan has fixed interest or variable rates. Shortening your loan term can help save money on interest, but it may increase your monthly payments. Make sure the loan fits your needs and budget.

How to Ensure You Get the Best Car Loan Interest Rates

Tips for Comparing Loan Interest Across Lenders

- When comparing loan interest across lenders, it’s important to understand how they calculate interest.

- Loans typically use simple interest, which means that the interest is not compounded.

- You can focus on the principal balance of the loan and look at the portion of the loan that goes towards interest.

- Comparing different lenders will help you find the best rates and determine how much interest you will pay throughout the loan.

Final Steps to Apply for a Car Loan

Use a Loan Calculator to Estimate Your Payments

Before applying for a car loan, use a loan calculator to estimate your payments. This will give you a better idea of how much you will pay each month. A loan calculator will show you the interest that has accrued and how it affects your monthly payments. You can adjust the loan amount, interest rate, and loan term to see how they impact your payments and the total cost of the loan. This tool helps you make an informed decision.

How Car Loan Interest Rates Work Over Time

Steps to Secure a Car Loan with Less Interest

- To secure a car loan with less interest, focus on lowering your loan principal.

- A larger down payment can help reduce the amount you borrow, which means you’ll pay less interest.

- Also, consider shorter loan terms because they often offer lower interest rates.

- Be sure to review the principal and interest breakdown so you understand how much interest you’ll pay over the life of the loan.

- If you’re buying your first car, working with a credit union can help you save on interest.

Final Thoughts:

Car loans typically use simple interest, not compound interest. This means your lender will not charge interest on interest. The lenders calculate interest and principal separately. If you make extra payments toward the loan principal, it can help you pay off the loan faster and reduce the interest you’ll pay. Understanding how compound interest works on your car loan helps you manage your payments better and ensures that you’re not paying more than necessary.

FAQ’s:

Do car loans use compound interest?

No, most car loans, including those from credit unions, use simple interest. This means your lender charges interest only on the principal loan amount, not on previously accumulated interest.

How is car loan interest calculated?

Car loan interest is typically calculated using simple interest. The interest is based on the loan principal and is applied to the outstanding balance throughout the loan term.

Can I save money by paying off my car loan early?

Yes, if you pay off your car loan early, you can reduce the principal balance and the total interest you pay over the life of the loan since lenders calculate interest based on the remaining balance.

What happens if I make extra payments on my car loan?

Extra payments reduce your loan principal, which can help lower the amount of interest you’ll pay over time, allowing you to pay off the loan faster and save on overall costs.

Are credit unions a good choice for car loans?

Yes, credit unions often offer lower interest rates compared to traditional banks. They may also provide more flexible loan terms, which can help you save on interest over the life of the loan.