The best mortgage rates for cooperative units can greatly impact your home-buying experience. Many buyers see co-ops as a budget-friendly path to homeownership. Understanding how these rates work is important. Loans for cooperative units differ from traditional mortgages. Buyers purchase shares in a cooperative corporation instead of owning the property directly. Residents become shareholders, which gives them the right to occupy a specific unit.

Several considerations come into play when evaluating the best rates. You should assess the current market conditions, costs, and monthly fees associated with the co-op. It is essential to shop around to find the best deal. You must pay attention to financing requirements and responsibilities as these can affect your overall costs. Working closely with your co-op’s board can provide insights into common goals and community engagement. Researching these aspects can lead to significant savings and help you secure a better rate.

What Are Cooperative Units?

Cooperative units, or co-ops, are a unique form of homeownership. Buyers do not purchase the unit itself. Instead, they buy shares in a cooperative corporation. These shares give them the right to occupy a specific unit. Residents in co-ops are also shareholders. They collectively make decisions about the property and share responsibilities, including maintenance costs. Understanding the mortgage rates for cooperative units is crucial for potential buyers.

How Cooperative Unit Mortgages Work

Mortgages for cooperative units differ from traditional home loans. Lenders view co-ops differently since the buyer doesn’t own the property outright. When applying for a mortgage, buyers need to show financial stability. Lenders will look at the cooperative’s financial health as well as the buyer’s finances. Knowing how these mortgages work can help buyers navigate the process effectively.

Current Trends in Mortgage Rates for Cooperative Units

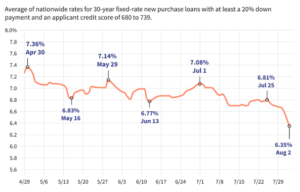

Analysis of Recent Rate Changes: The market for mortgage rates for cooperative units changes frequently. Recently, there has been a trend of rising interest rates. This impacts the overall cost of borrowing. Buyers need to stay informed about current rates to make the best financial decision. By understanding these changes, buyers can anticipate potential fluctuations in costs.

Factors That Influence Cooperative Mortgage Rates

Credit Score: A buyer’s credit score plays a significant role in determining their mortgage rates for cooperative units. Higher scores typically result in lower rates. Buyers should work on improving their credit score before applying for a mortgage.

Down Payment: The size of the down payment also affects the mortgage rate. A larger down payment can lower the interest rate on the mortgage. Buyers should aim to save for a substantial down payment to secure better rates.

Cooperative’s Financial Health: The financial health of the cooperative impacts mortgage rates for cooperative units. Lenders will consider how well the co-op is managed financially. A stable and well-managed co-op can lead to better rates for buyers.

Loan Term: The term of the loan influences the mortgage rates as well. Shorter loan terms typically come with lower interest rates. Buyers should consider their long-term plans and financial situation when deciding on the loan term.

Market Trends: Current market trends affect **mortgage rates for cooperative units**. Economic indicators, such as inflation and unemployment rates, can lead to changes in rates. Buyers should stay informed about the broader economic landscape to anticipate potential rate changes.

How to Find the Best Mortgage Rate for a Cooperative Unit?

Shop Around for Lenders: Finding the best mortgage rates for cooperative units requires shopping around. Different lenders offer various rates and terms. Buyers should compare offers from multiple lenders to find the most favorable terms.

Improve Your Credit Score: Improving a buyer’s credit score can lead to better mortgage rates. This may involve paying off debts or making payments on time. A higher credit score can help secure a lower interest rate.

Negotiate with the Cooperative Board: Negotiating with the cooperative board can also affect the mortgage terms. Buyers should communicate their financial situation to the board. Sometimes, the board can provide options that help buyers secure better rates.

Lock in Your Rate: Locking in a mortgage rate can protect buyers from rising rates. If a buyer finds a favorable rate, they should consider locking it in to avoid future increases. This is especially important in a fluctuating market.

Common Mistakes to Avoid

Many buyers face common pitfalls when seeking mortgage rates for cooperative units. One common mistake is failing to research thoroughly. Buyers should not rush into a decision without understanding the terms. Another pitfall is not considering the cooperative’s financial health. Buyers must assess the co-op’s financial situation before committing to a mortgage.

Bottom Lines

Understanding mortgage rates for cooperative units is essential for potential buyers. Cooperative units provide a unique way to own a home. By staying informed about current rates and trends, buyers can make better financial decisions. Shopping around and negotiating can lead to securing favorable rates.

FAQ

- What are cooperative units?

Cooperative units, or co-ops, are a type of homeownership where buyers purchase shares in a cooperative corporation.

- How do I find the best mortgage rates for cooperative units?

To find the best rates, shop around for lenders, improve your credit score, and negotiate with the cooperative board.

- What factors influence mortgage rates for cooperative units?

Factors include credit score, down payment, cooperative financial health, loan term, and market trends.

- Can I lock in my mortgage rate?

Yes, locking in your mortgage rate can protect you from potential increases in the future.

- What are common pitfalls to avoid when applying for a co-op mortgage?

Common pitfalls include rushing into decisions and not considering the cooperative’s financial health.