Personal Loans and Auto Loans

A Personal Loan?

A personal loan is an unsecured loan, which means it doesn’t require collateral like your car. If you qualify for a personal loan with excellent credit, you might get a lower interest. But keep in mind, if your credit is not strong, the personal loan may come with a higher interest rate than your auto loan.

How Does an Auto Loan Work?

Comparing Personal Loans vs. Car Finance

When deciding between a personal loan or an auto loan, it’s essential to understand the differences. A personal loan might have higher interest because it’s unsecured, while a car finance option like a secured loan ties the loan to the car. If you’re considering a personal contract purchase or other finance options, check your credit score to see which loan offers better terms.

Should I Use a Personal Loan to Pay Off My Car Loan?

Benefits of Using a Personal Loan to Pay Off My Car

- Using a personal loan to pay off the car can offer flexibility.

- Personal loan lenders might provide better terms if you have good credit.

- By paying off the car with a personal loan, you might secure a lower loan interest rate, depending on your credit.

- This could help you pay it back more comfortably over time.

- Read this comprehensive guide on should I get a personal loan for a car to make an informed decision before applying for a loan.

Potential Risks of Taking Out a Loan Early

How a Loan Could Impact Your Credit Score

A loan can impact your credit score in both positive and negative ways. If you accept the loan and make payments on time, your credit score will take a positive hit. However, if you miss payments, the loan interest rate could make the situation worse by affecting your score negatively. Always use a loan calculator to determine how much the loan and auto loan may cost you. Use our loan calculator to estimate how much your loan will cost and see how it could impact your credit score.

Factors to Consider Before Taking a Personal Loan

Monthly Payment Considerations

Before taking out a personal loan, consider the monthly payment you can afford. Whether you use the loan to pay for a car or something else, make sure the monthly payments fit your budget. Compare the loan interest rate between a personal loan and an auto loan to understand what you’ll be paying each month. Try our payment personal loan calculator to determine the monthly payment you can afford and compare it to your current auto loan.

Impact of Bad Credit on Loan Approval

Compare Personal Loan Terms with Auto Loan Terms

Personal loans tend to have higher interest rates compared to auto loans. This is because personal loans are typically unsecured, while auto loans are secured by the car. If you’re looking to pay off a car with a personal loan, be aware that the life of the loan might be shorter or longer than your auto loan, depending on your loan terms. Use a personal loan calculator to compare the terms and see which option works best for you.

Steps to Get a Personal Loan to Pay Off My Car

How to Get a Personal Loan

To get a personal loan to pay off your car, first, check your credit score. Lenders that offer personal loans will depend on your credit score to decide your loan amount and interest rate. Once you’re sure of your credit status, apply for the loan and provide the necessary documents. A personal loan allows you to use the funds for anything, including paying off a car.

Evaluate Your Loan to Pay Strategy

Taking Out a Loan for Credit Card Debt or Car Loan

If you’re looking to pay off credit card debt or a car loan, taking out a personal loan might be a good option. With personal loans and car finance, you can consolidate your debt into one monthly payment. You can pay off the car loan or credit card balance in monthly installments until the loan is fully paid.

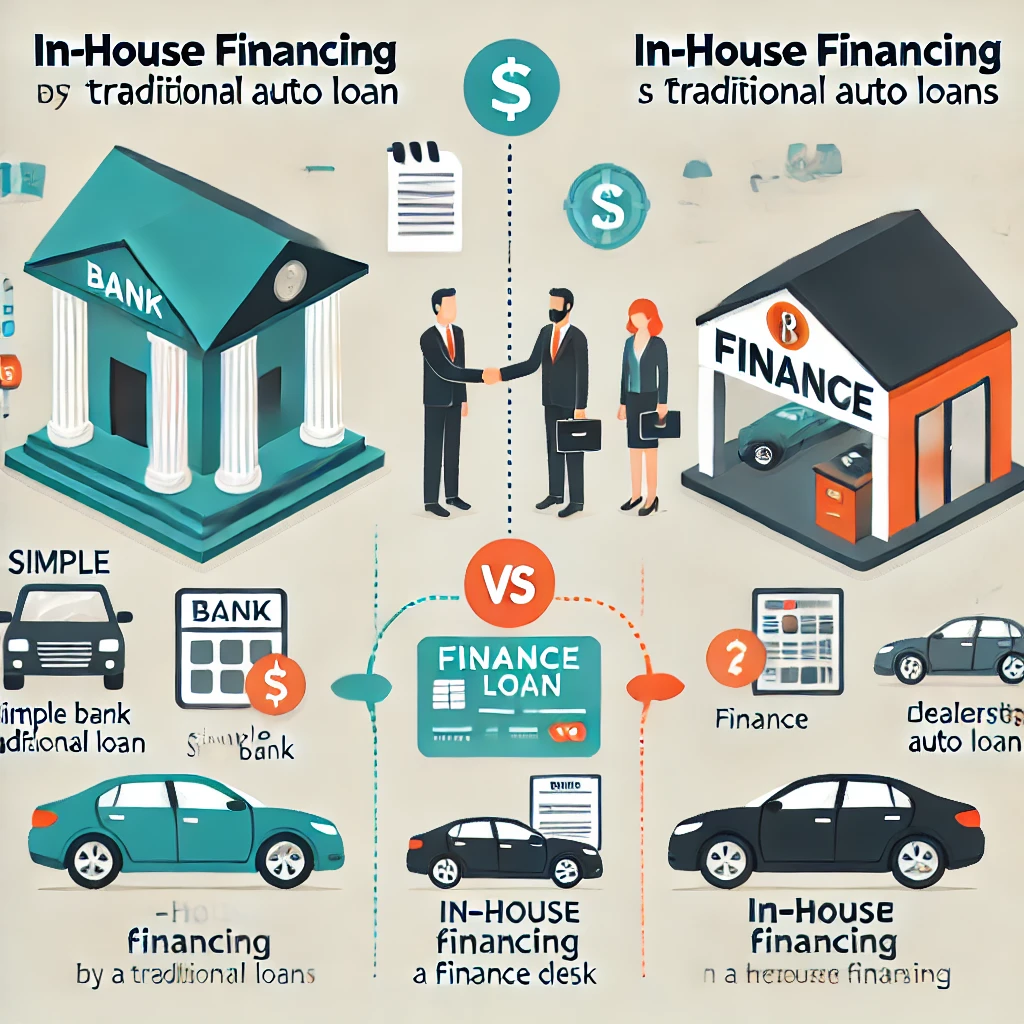

Alternatives to Personal Loans for Car Finance

Using Car Finance Options to Pay Off Your Auto Loan

Instead of taking out a personal loan, consider using car finance options to pay off your auto loan. Car finance options allow you to buy a new or used car and make payments in monthly installments. You might find that using car finance as well as refinancing can help you manage payments more effectively.

Consider Refinancing to Lower Monthly Payments

Is It Better to Finance a Car or Pay Off My Car Early?

When deciding whether to finance a car or pay off your car early, consider your current financial situation. Financing a car allows you to secure the loan and spread out the payments, but paying off the car early might save you money on interest. If you have a bad credit score, paying off the car early could help better your credit over time, but financing might offer lower personal loan interest rates if your credit improves.

Conclusion

FAQ’s

Can I use a personal loan to pay off my car loan?

Yes, you can use a personal loan to pay off your car loan. This option can help consolidate your debt into one payment. Make sure to check the loan interest rates and terms before proceeding.

How does a personal loan affect my credit score?

A personal loan can affect your credit score in several ways. If you make timely payments, it can help improve your credit score. However, missing payments can hurt your credit score, so it’s important to stay on track.

Is it better to finance a car or use a personal loan to pay off my car loan?

It depends on your financial situation. If you have good credit, a personal loan with a lower interest rate may help pay off your car loan faster. However, financing a new car might be a better option if you plan to buy a car and want to secure better loan terms.